The Gold Price Analysis market is capturing significant attention as the price of gold (XAU/USD) shows signs of a potential breakout after consolidating near key resistance levels. In this detailed analysis, we will dissect the current technical setup, the impact of the US dollar’s movement, and key price levels traders should watch for the next big move in gold. Whether you are an active trader, investor, or simply interested in precious metals, understanding the forces at play right now can help you position your trades effectively.

Current Market Overview: Gold Versus the US Dollar

One of the most important relationships to understand in precious metals trading is the dynamic between Gold Price Analysis. These two assets traditionally share an inverse relationship—when the US dollar weakens, gold tends to strengthen, and vice versa. This is because gold is priced in US dollars globally, so fluctuations in the dollar directly affect the price of gold.

Currently, the Gold Price Analysis market is showing signs of potential movement as the US dollar is consolidating, giving gold the opportunity to stabilize and possibly move higher.

Technical Analysis: Key Levels and Chart Patterns

The Uptrend Channel and Support Testing

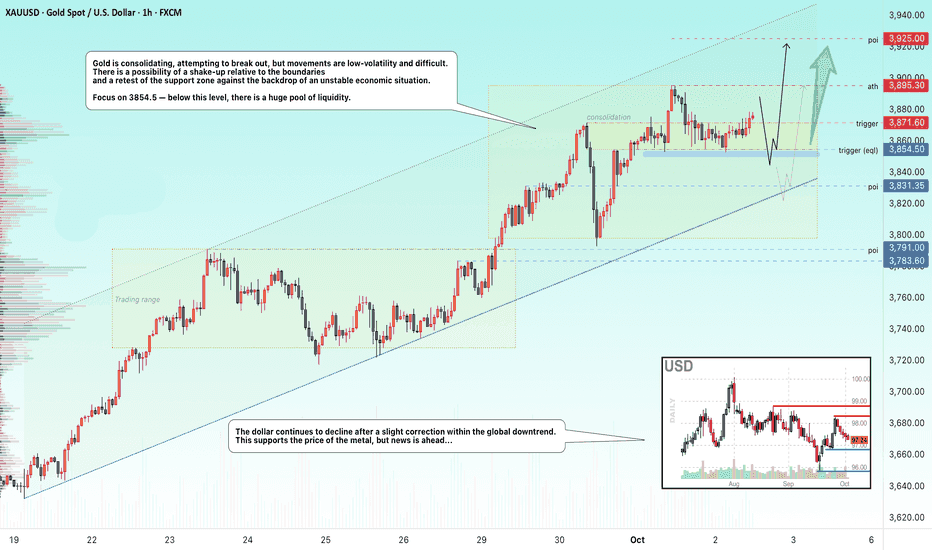

Looking closely at the hourly chart of XAU/USD, gold is trading within a clearly defined uptrend channel, with price action demonstrating higher highs and higher lows. This bullish momentum reflects strength in the gold market, even as the US dollar pauses.

The interaction between Gold Price Analysis here is crucial. The consolidation in the dollar is providing a supportive environment for gold to test support levels within this channel.

Resistance at $3,863: The Critical Barrier

Resistance around the $3,863 mark represents a key technical barrier. This level has been tested multiple times without a decisive breakout, but if gold can push above this resistance, it would signal strong buying momentum.

A breakout here in the context of Gold Price Analysis would indicate that the dollar’s weakness is fueling gold’s rally, potentially pushing prices toward the next significant level at $3,900.

What Could Trigger the Next Move?

The Role of the US Dollar in Gold’s Price Action

In the ongoing battle of Gold Price Analysis, the dollar’s direction is often the determining factor in gold’s price moves. Right now, the US dollar is in a phase of consolidation, meaning traders are waiting for fresh economic data before making a big move.

If the dollar weakens after this pause, it would give gold more room to climb. This is a classic scenario in the gold versus the US dollar dynamic: a weaker dollar generally supports stronger gold prices.

Market Sentiment and Economic News

Beyond technical factors, Gold Price Analysis is also influenced by broader economic and geopolitical events. Inflation rates, Federal Reserve policies, and geopolitical tensions play pivotal roles in driving investor behavior in these markets.

Upcoming economic announcements could shift sentiment quickly, impacting both the US dollar and gold prices simultaneously.

Potential Scenarios: What to Expect Next in Gold

Scenario 1: Breakout Above $3,863

If gold breaks out above $3,863, it would confirm bullish momentum in the ongoing Gold Price Analysis battle. Traders should watch for strong volume and follow-through buying as signs of a potential move toward $3,900.

This breakout would indicate that gold is capitalizing on dollar weakness, providing an opportunity for traders to enter long positions.

Scenario 2: Correction or Consolidation

If gold fails to clear $3,863 resistance, it may pull back into a correction phase, testing support between $3,753 and $3,837. This would mean a temporary pause or consolidation in the Gold Price Analysis dynamic before the next move.

Monitoring how gold behaves within this support zone is essential to gauge whether the uptrend remains intact or if a deeper correction is underway.

Key Trading Levels to Watch

- Resistance: $3,863 (major breakout level)

- Next target if breakout: $3,900

- Support zone: $3,753 – $3,837

- Lower support: Around $3,791 (channel support)

Understanding these key price points in the context of Gold Price Analysis will help traders make better-informed decisions.

Why Gold Remains a Valuable Investment Now

The ongoing tug-of-war between Gold Price Analysis highlights gold’s role as a safe-haven asset, especially in times of inflation, currency volatility, and geopolitical uncertainty.

As the US dollar weakens or consolidates, gold often benefits, making it a strong candidate for portfolio diversification and wealth preservation.

Final Thoughts: Be Ready for Volatility and Opportunity

The relationship between Gold Price Analysis is at a crucial turning point. With the US dollar consolidating and gold testing resistance at $3,863, traders should prepare for potential volatility.

Whether gold breaks out to new highs or pulls back to consolidate, understanding the intricate dynamics of Gold Price Analysis will be key to capitalizing on upcoming market movements.

Stay Updated with Our Gold Market Analysis

Subscribe to our newsletter and follow our blog for the latest gold price forecasts, technical analysis, and trading strategies centered around the Gold Price Analysis market. Our real-time insights and market breakdowns help you navigate the precious metals landscape with confidence.

Gold price forecast, XAU/USD technical analysis, Gold breakout strategy, Gold Price Analysis, Gold vs US dollar, Is gold a good investment now, Gold price resistance levels, Gold chart analysis, Buy gold now or wait, Precious metals market update.