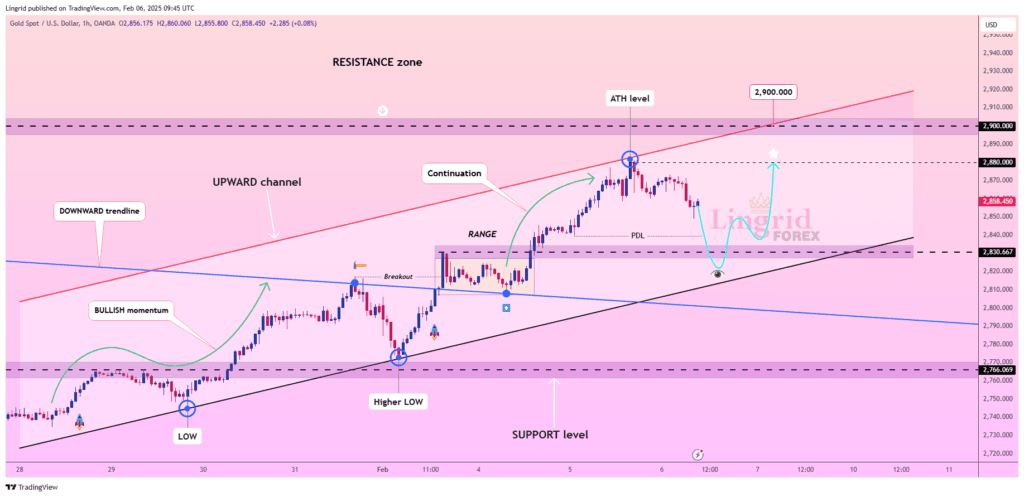

GOLD correction and the Road to continues to climb, breaking above the 2850 level. At this point, the market appears unstoppable, pushing higher and higher. However, at times like this, the market sometimes does the opposite so we have to be careful. Despite this, given the current bullish momentum, any pullback may present an opportunity to go long, especially as the price reaching 2900 this week seems plausible. With the ongoing tariff war driving up gold correction prices, I anticipate the market may roll back from the resistance zone around 2870-2880, followed by a continuation upward. My goal is resistance zone around 2895

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

The price has started pulling back from the resistance zone, as I mentioned yesterday, and is currently moving toward the previous day’s low (PDL). It’s possible that the market may dip below the PDL before continuing to higher levels. As the market approaches this key level, we should remain vigilant, as price tends to react quickly to news around such critical areas. At this point, we could potentially see the formation of a bullish flag pattern or a complex pullback. If the price does retest the support level, we should wait for confirmation before considering a long position. My goal is resistance zone around 2880

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.