It’s worth noting that while all of these strategies are tried and true for expert traders, they may not always result in serious profits. Binary options trading is an extremely volatile market. Even with the right know-how and strategies in place, you could find yourself with significant losses. In general, it is recommended not to risk more than 5% of your total capital with binary options trading. In fact, many expert traders opt to only risk about 1% to 2% of their total capital.

Top 7 Best Binary Options Strategies

1. Follow Trends

2. Follow the News

3. The Candlestick Formation Patterns Strategy

4. The Hedging Strategy

5. The Pinocchio Strategy

7. Fundamental Analysis

1. Follow Trends

No matter your market or asset, the best way to make money with binary options is to follow trends. Asset prices will fluctuate with trends, and prices will grow or shrink with their associated assets. This is because the binary options market is based on trader speculation, all in real-time. Trends will follow a zigzag pattern, and traders following this strategy will trade with current trends or with swings. Examine your chart and look at your trend lines. If a line is flat, then look for a different asset to trade. If the line is rising, there’s a good chance that the price will go up.

Bitcoin price chart

A moving average (MA) is a commonly used indicator for identifying the direction of the trend.

In this example Bitcoin’s price began to trend upwards after crossing MA from below and trading above for some time. If a strong trend is in place then price retracements to MA might be a good entry point.

2. Follow the News

This aligns well with our first strategy. Following different news events that relate to your asset can help you predict how it will trade. Following the news is a lot easier than technical analysis, making it great for beginner traders. Look at the news online, on television, over the radio, and in newspapers once you pick your asset of choice. Follow tech companies and identify when an announcement is about to be made. If a company is about to release a new product, you can opt to purchase options and wait for the profits to come in once the product is released.

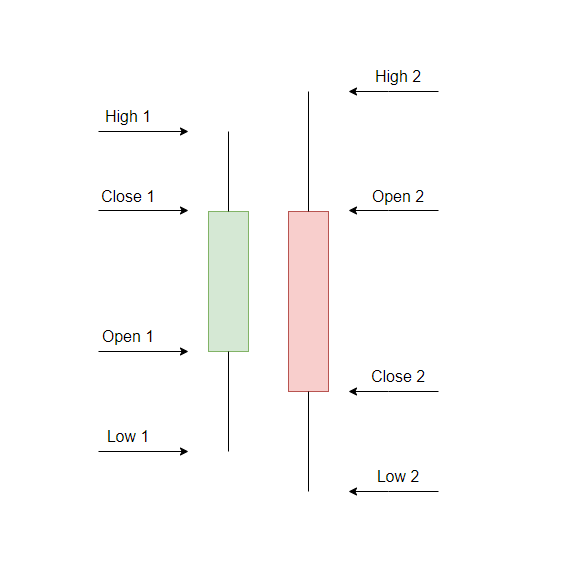

3. The Candlestick Formation Patterns Strategy

If you can read asset charts, give this strategy a shot. Candlesticks show traders how an asset changes over time. The bottom of the candle is the lowest price that asset reached, while the top of the candle is its highest historical price. With this chart, one can also see the opening and closing prices of the asset. When examining the history of an asset, you will likely see a pattern occurring. During certain times, the asset will rise or fall. With this in mind, traders can place call or put options based on the historical trends of the asset.

Candlestick Patterns Strategy

There is a large amount of candlestick patterns and you can learn the most popular ones in our article Top 20 Chart Candlestick Patterns.

4. The Hedging Strategy

This simple but not always accurate strategy is worth trying out as a newbie. This process involves placing both a call and a put option on an asset at the exact same time. No matter where the price may go, you’ll still make money. Still, you will need to accurately calculate the risk and cost of losing that option to ensure that you don’t actually lose that money when your trades expire.

5. The Pinocchio Strategy

The Pinocchio Strategy, often referred to as the “Pin Bar” strategy in the realm of Forex and binary options trading, is based on a particular candlestick pattern. The name “Pinocchio” is derived from the famous children’s fairy tale character whose nose grew longer whenever he lied. Similarly, the Pin Bar has a long wick (or “shadow”) and a small body. The wick should be at least two to three times the size of the body. This wick is symbolic of the “nose” and indicates that the market is “lying” about its real direction, the direction of the wick indicates the opposite of the prevailing trend. For instance, a long wick to the upside indicates a potential bearish reversal.

It works best in ranging, consolidating markets with established trading ranges. Big breakouts invalidate the strategy. The Pin Bar’s effectiveness is higher when it forms at significant support or resistance levels, or in confluence with other technical indicators or chart patterns.

The Pinocchio Strategy

6. Mean Reversion Strategy

The mean reversion strategy is based on the concept that asset prices and trends that become too extreme and diverge significantly from an average price will eventually revert back toward the mean. This strategy works well in ranging markets that oscillate around a central price level.

To implement the mean reversion strategy:

Identify the average price level that the asset tends to fluctuate around based on historical price data. This is the “mean” price.

Analyse recent price action – if the asset price has moved significantly above or below the mean, it may be due for a pullback towards the average. These deviations can be identified using technical indicators like Bollinger Bands, which highlight periods when the price is far from the mean.

Place call options if the price is below the mean, expecting it to revert upwards. Place put options if the price is above the mean, expecting it to fall back down.

Set expiration times relatively close, as mean reversion movements tend to happen quickly in ranging markets.

Monitor technical indicators like the RSI to identify overbought/oversold levels that may precede a reversal.

The mean reversion strategy works best in stable, low-volatility markets that often trade within defined boundaries. It allows traders to profit from short-term fluctuations rather than long directional moves. Rigorous analysis of average prices is key to success with this approach.

7. Fundamental Analysis

Many day traders use this strategy. Though, it’s not so much of a strategy as it is a tool designed to help traders grasp an asset with more accuracy. The goal of this strategy is to get data about your asset so you can profit from that asset later on. If you’re unfamiliar with a particular asset and the market is volatile and has the potential for wins, place a small trade on that asset. Do this to test out a strategy that you think will be profitable. If your strategy works, then you can place a larger amount on that asset for bigger gains.

💥 Contact me, to get Indicator’s License:

👉 Skype: @fadelqasim

👉 Telegram: https://t.me/fadelqasim

👉 Email: support@qasimproindicators.com

one of the good strategy bro. thanks for share to us